91752 Residential Real Estate Market Update (Jurupa Valley-Eastvale) – December 2023

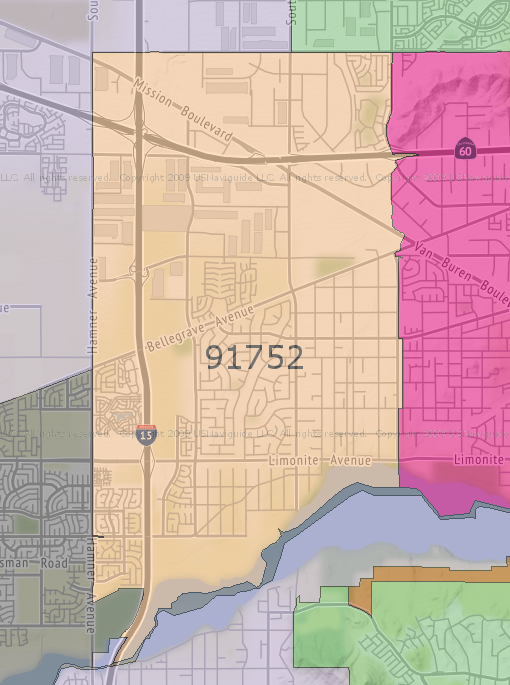

The 91752-zip code, located in Riverside County, California, encompasses a small part of the city of Eastvale (east of Hamner Avenue) and the western part of the city of Jurupa Valley (Mira Loma area). The history of the ’52 zip code is closely tied to the development of these communities. Here’s a brief overview:

Throughout the 19th and early 20th centuries, the area was predominantly agricultural. It was known for its dairy farms and fields of crops, which benefited from the region’s fertile soil and favorable climate.

After World War II and into the 20th century, like many areas in Southern California, the region began to transform. The growth of the Los Angeles metropolitan area, improvements in transportation, and the increasing demand for suburban housing led to the development of residential communities, eventually becoming the cities of Eastvale and Jurupa Valley.

Today, the 91752-zip code is characterized by its suburban residential communities, commercial developments, and remaining agricultural areas. It is a reflection of the larger trends in Southern California’s Inland Empire – a shift from rural to suburban and urban landscapes.

The history of the 91752-zip code is a microcosm of the broader changes in Southern California – from indigenous lands to agricultural heartland, to a thriving suburban area. It reflects the dynamic and ever-evolving nature of the region.

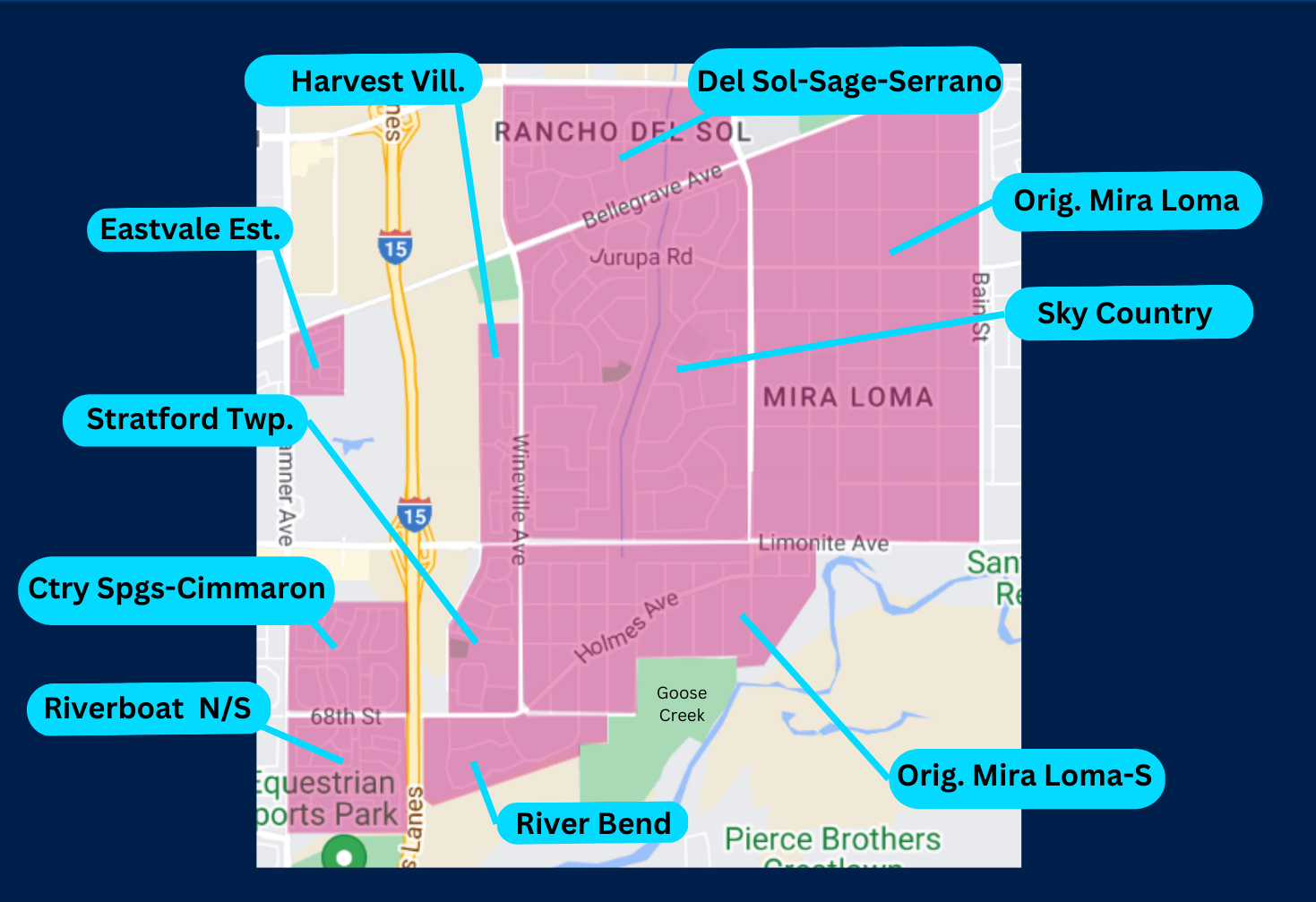

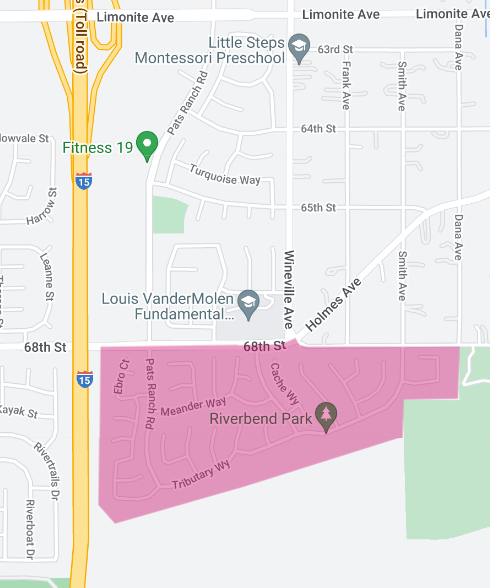

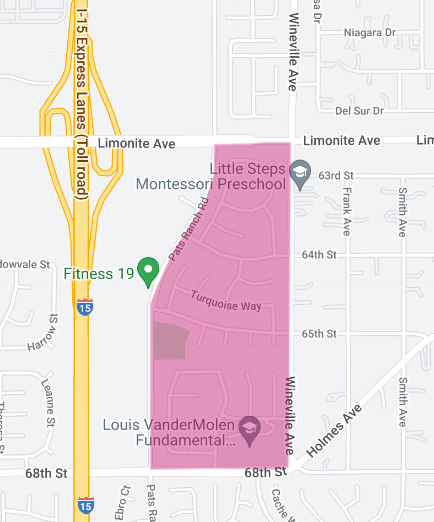

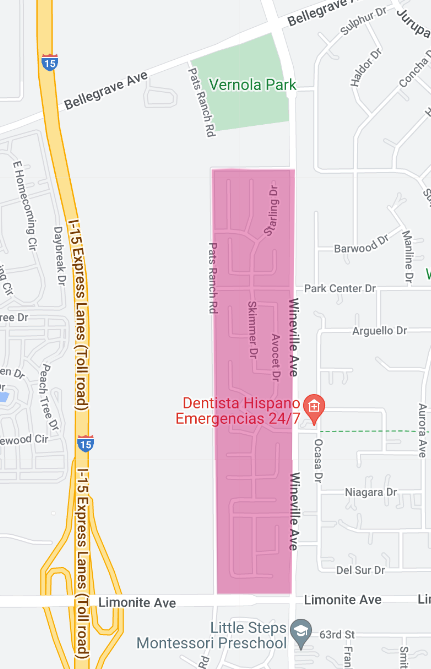

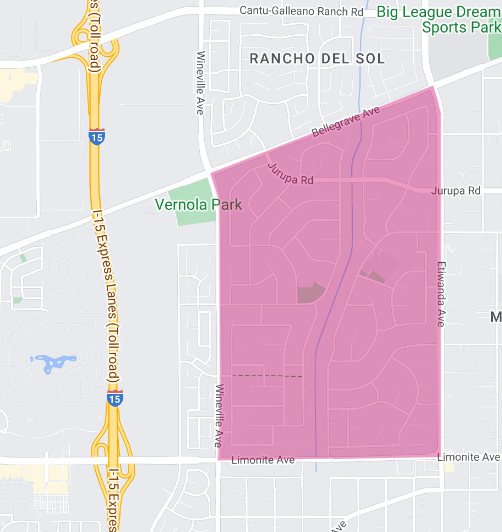

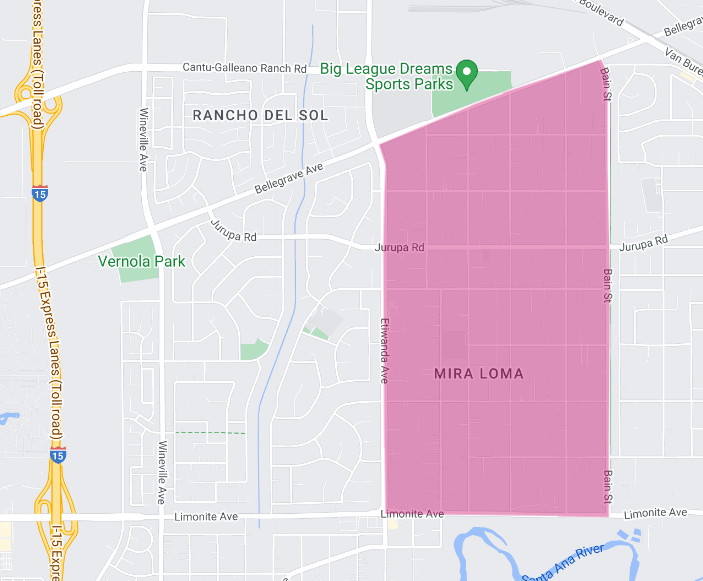

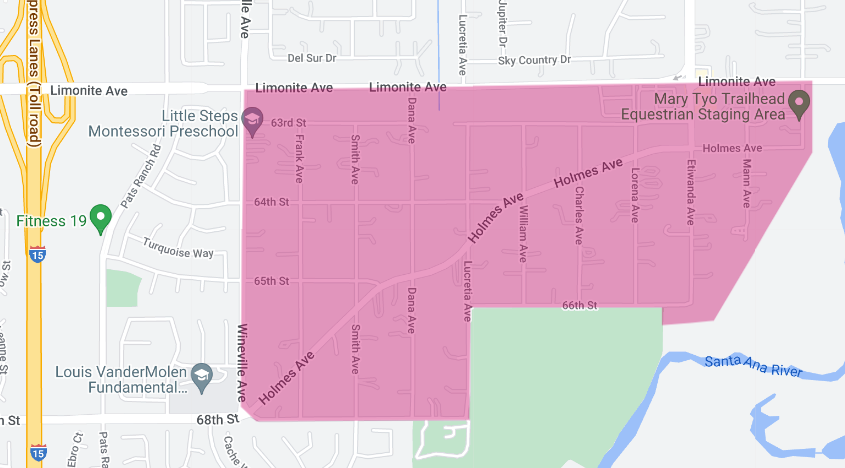

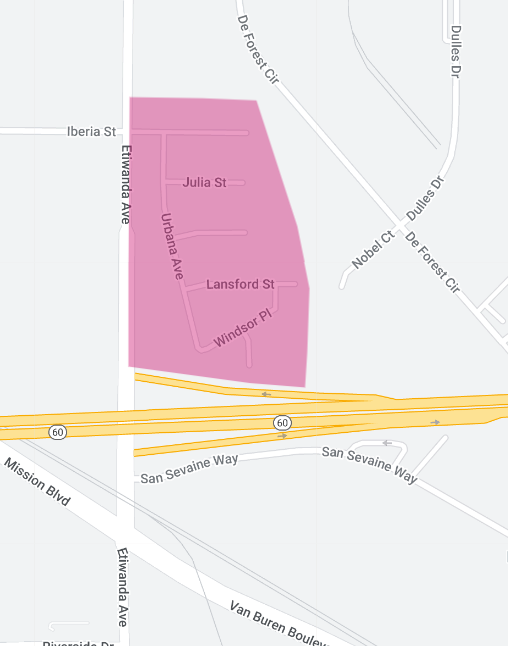

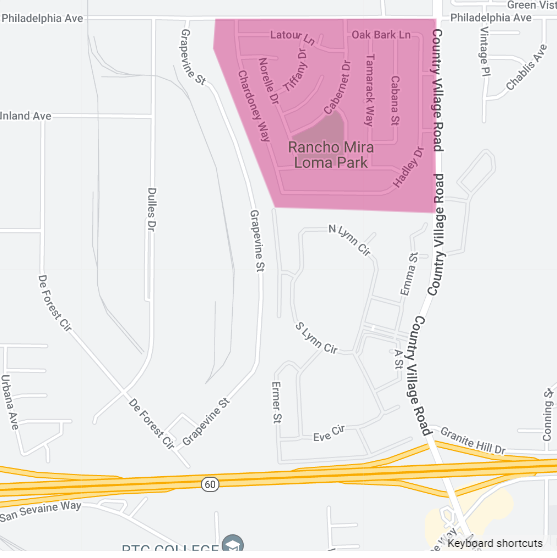

The image below displays the ten main residential areas in the 91752 consisting of single-family homes which is the focus of this report.

Specifically, in the city of Eastvale, the homes adjacent to Riverboat Dr. (south of 68th St., east of Hamner Ave); the Country Springs/Cimmaron Ranch area (north of 68th St. and east of Hamner Ave.); and the Eastvale Estates area (south of Bellegrave Ave, east of Hamner Ave.).

Also, in the city of Jurupa Valley, the River Bend tract (south of 68th St.), the Stratford Township tract (south of Limonite Ave, north of 68th St., west of Wineville Rd.); Harvest Villages (north of Limonite, west of Wineville Rd,); Sky Country; Rancho Del Sol-Sage-Serrano Ranch area (north of Bellegrave, west of Etiwanda, south of Cantu Galleano, and east of Wineville Rd.); and original Mira Loma, central and south.

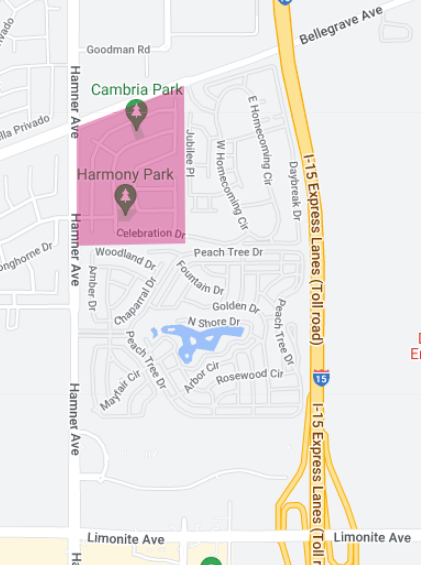

AREA: Eastvale Estates (Bellegrave Ave./Hamner Ave)

Western Edge of 91752 ZIP Code, Eastvale, CA

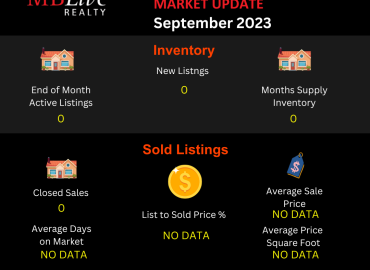

This report presents a focused analysis of the residential real estate market for Eastvale Estates, a community located on the western edge of the 91752 ZIP code in the City of Eastvale, for the month ending December 2023. The goal is to provide a clear and straightforward overview of the current market dynamics.

Notably, as of the end of December, there were no active listings in Eastvale Estates. This represents a significant decrease of 100% compared to the same period last year. This is a remarkable situation, suggesting a complete lack of available properties on the market at the end of December. Such a scenario could be indicative of a highly sought-after area where properties are quickly purchased or a market where homeowners are currently disinclined to sell.

In line with the absence of active listings, there were also no new listings added during the month, maintaining a status quo from the previous year. This lack of new listings further emphasizes the stagnant nature of the market in terms of new offerings.

Unfortunately, there is no data available regarding the Months Supply Inventory, Closed Sales, Average Days on Market, List to Sold Price Percentage. This absence of data limits our ability to deeply analyze the market dynamics in terms of sales activity, pricing trends, and market velocity.

However, we do have information on the Average Sales Price, which stands at $805,000, and $327 average per square foot. Both of these metrics are calculated based on a rolling 6-month average. This price point positions Eastvale Estates in a higher bracket of the real estate market, reflecting the area’s desirability and potentially high-quality housing stock.

In conclusion, the Eastvale Estates residential real estate market, as of December 2023, is characterized by a complete absence of active and new listings. This suggests a static market with potentially high demand but very limited supply.

The high average sales price further cements Eastvale Estates as a premium residential area. Potential buyers interested in this area may face challenges due to the lack of available properties, while current homeowners might benefit from the high value of their properties if they decide to enter the market.

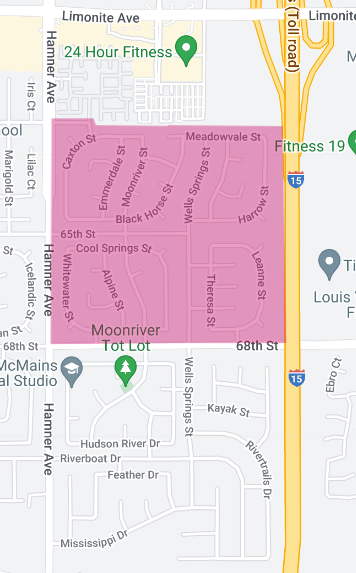

Area: Cimmaron Ranch/Country Springs

Western Edge of 91752 ZIP Code, Eastvale, CA

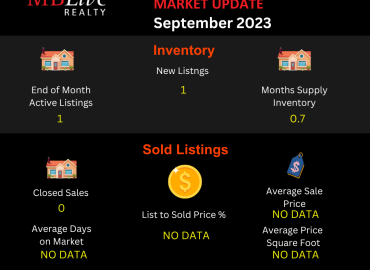

This report provides a current overview of the residential real estate market for Cimmaron Ranch/Country Springs, located on the western edge of the 91752 ZIP code, for the month ending December 2023. The focus is to present a clear and straightforward overview of the current market dynamics.

One of the most striking aspects of the current market in the Country Springs-Cimmaron Ranch communities is the complete absence of active listings at the end of December.

This scenario shows a 100% decrease from the same period last year, indicating an extraordinary situation in the local market. Such a drastic drop could be due to a variety of factors, including high demand for homes in this area that has outstripped supply, or a unique market condition where homeowners are holding onto their properties.

Similarly, there were no new listings in December, which is consistent with the figure from the previous year. This lack of new inventory coming onto the market suggests that homeowners might be waiting for more favorable conditions to sell, or it could point to a high level of satisfaction with the area, leading to low turnover in property ownership.

Interestingly, the average sales price in the Country Springs-Cimmaron Ranch area has seen a slight increase of 0.6% from last year, standing at $858,296. This increase, calculated using a rolling 6-month average, indicates a stable and slightly appreciating market in terms of property values. This gradual rise in average sales price could be attractive to potential sellers considering the market’s current dynamics.

In contrast, the average price per square foot has seen a decrease of 3.2% from last year, now at $274. This reduction, also based on a rolling 6-month average, might suggest that while overall property values are stable, there could be a shift in the types of properties being sold or variations in the market desirability of certain home features.

Unfortunately, there is no available data regarding the Months Supply Inventory, Closed Sales, Average Days on Market, or the List to Sold Price Percentage for December 2023. This lack of data limits our ability to fully understand the dynamics of the Country Springs-Cimmaron Ranch residential market in terms of sales activity and pricing trends.

In summary, the Country Springs-Cimmaron Ranch area is currently experiencing a unique market situation with no active or new listings as of December 2023. The slight increase in the average sales price coupled with a decrease in the average price per square foot presents a mixed picture, potentially indicative of a market in transition.

For buyers, this could mean limited options in the near term, while sellers might find a receptive market for their properties.

Area: Riverboat Dr. Area Homes

Western Edge of 91752 ZIP Code, Eastvale, CA

This report provides a comprehensive analysis of the residential real estate market, specifically the homes south of 68th Street, and adjacent (north/south) to Riverboat Drive in Eastvale, CA, for the month ending December 2023. Our focus is to offer a clear and concise overview, suitable for a wide range of stakeholders including homeowners and potential buyers.

At the close of December, there were 2 active listings in the area, marking a significant 50% decrease from the same time last year. This reduction in active listings suggests a tight market, with fewer options available for prospective buyers. It could also indicate a shift in the local market dynamics, possibly due to increased demand or homeowner reluctance to sell.

Interestingly, there were no new listings in December, mirroring the trend from the previous year. This consistent lack of new inventory indicates a static market in terms of new properties entering the market, which could be influencing the overall scarcity of available listings.

The Months Supply Inventory stands at 1.4, showing a notable decrease of 41.7% from last year. This metric signifies how long the current inventory of properties would last at the current rate of sales if no new properties were listed. A lower months supply typically indicates a seller’s market, where demand outstrips supply.

There was 1 closed sale in December, contrasting sharply with the zero closed sales in December of the previous year. This uptick, although modest, could be a sign of some movement in the market, suggesting that properties that do come up for sale are finding buyers.

The average days on market for properties is 63, a figure that offers insight into the average time it takes for properties to sell. This duration can be influenced by several factors, including pricing, property features, and market conditions.

Properties are selling at an average of 96.5% of their listed price. This list to sold price percentage is a critical indicator of the market balance, suggesting that while sellers are getting most of their asking price, buyers also have some room for negotiation.

The average sales price in the area is $872,500, which is a 4.6% increase from the previous year, as per a rolling 6-month calculation. This increase is indicative of a robust market with appreciating property values, likely driven by a combination of high demand and the desirable nature of the area.

However, the average price per square foot has seen a decrease of 3.8% from last year, now standing at $275. This decrease, also calculated using a rolling 6-month average, could indicate a shift in the types of properties being sold or changes in market preferences.

In summary, the residential real estate market around Riverboat Dr. is experiencing a phase of reduced inventory with a significant drop in active listings compared to last year.

Despite the lack of new listings, the market is showing signs of activity with an increase in the average sales price, although the average price per square foot has decreased slightly.

The market currently favors sellers, but with properties selling at slightly below the list price, there remains an opportunity for negotiation for interested buyers.

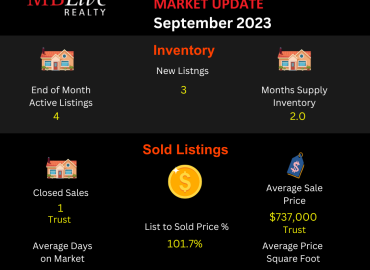

Area: River Bend Homes

Western Edge of Jurupa Valley 91752

As we analyze the River Bend residential real estate market for the month ending December 2023, it’s clear that the area has experienced some notable shifts compared to the previous year.

To begin with, the number of active listings at the end of the month was remarkably low, with just one property on the market. This represents an 80% decrease from the same period last year, indicating a significant tightening of available inventory. Such a drastic reduction in active listings illustrates a tight seller’s market, where the demand from buyers outstrips the supply of available homes.

Interestingly, there were no new listings in December, marking a complete absence compared to last year. This lack of new inventory contributes to the ongoing trend of limited availability in the River Bend area. This scarcity of new properties coming onto the market can create competitive conditions for buyers and may lead to faster sales and higher prices for the few available properties.

The Months Supply of Inventory, a critical measure of market balance, stood at just 0.5. This represents a substantial decrease of 82.1% from the previous year. A months supply inventory of less than 1 month typically indicates a tight seller’s market, where buyers have fewer options and may need to act quickly and decisively.

In terms of sales, there was 1 closed sale in December, a notable change from this time last year when there were no closed sales. This could be indicative of an increase in buyer activity or a reflection of the limited but high-demand inventory.

The average number of days homes spent on the market before being sold was 48. Unfortunately, there’s no comparable data from last year, but this timeframe suggests a relatively brisk pace for sales, likely driven by the low inventory and high demand.

An interesting metric to note is the list-to-sold price percentage, which was 101.5%. This indicates that, on average, homes sold for slightly more than their listing price, further emphasizing the competitive nature of the River Bend market and the strong position of sellers.

Using a 6-month rolling average, the average sales price for River Bend was $869,271, showing a decrease of 3.3% from the previous year. This decline in average sales price, despite the tight market conditions, could be influenced by a variety of factors, including the types of homes sold or specific buyer preferences.

Finally, the average price per square foot was $314, also calculated using a rolling 6-month average, which is a 15% increase from a year ago. This increase provides a valuable insight into the market’s upward valuation trend.

In conclusion, the River Bend residential market as of December 2023 was characterized by a significant scarcity of available homes, a market strongly favoring sellers, and a slight decrease in average sales prices compared to the previous year.

The unique dynamics of this market present both opportunities and challenges for sellers and buyers.

Area: Stratford Township Homes

Western Edge of Jurupa Valley 91752

As we wrap up December 2023, let’s delve into the residential real estate market dynamics for the Stratford Township residential area, highlighting the trends and changes from the past year.

Starting with inventory, there were 2 active listings at the end of December, reflecting a 33.3% decrease compared to the same period last year. This reduction in active listings indicates a tight market, though it’s less severe than in some other areas. Such a decrease can create a more competitive environment for buyers, especially in desirable locations.

The number of new listings remained stable at 1, showing no change from last year. This steadiness in new listings suggests a consistent rate of homes entering the market, which is crucial for maintaining a balanced supply and demand dynamic.

The Months Supply of Inventory (MSI), which gauges how long the current inventory of properties would last at the current rate of sales, was 1.3 months. This represents a 23.5% decrease from last year, pointing towards a market that favors sellers, but still offers some choices for buyers.

In terms of sales activity, there was 1 closed sale in December. There were 0 closed sales last year at this time, but a single sale in a month indicates a rather subdued market, potentially due to limited inventory or other market conditions.

A significant change was observed in the average days on the market, which increased by 71.4% from a year ago to 36 days. This longer duration before sale could suggest that buyers are taking more time to make decisions or that properties may not be aligning perfectly with buyer expectations.

The List to Sold Price Percentage stood at 89%, a decrease of 13% from the previous year. This lower ratio indicates that homes are selling for less than their asking price, which could be a sign of increased negotiation power for buyers, but more likely a mismatch between seller expectations and market conditions.

Using a rolling 6-month average calculation, the average sales price in the Stratford Township tract of homes was $794,600, marking a decrease of 4.3% from the previous year. This decline in average sales price reflects a variety of factors including changes in the types of homes sold, buyer preferences, or overall economic conditions.

However, the average price per square foot was $295, also determined by using a rolling 6-month average calculation, shows an increase of 13.0% from the previous year. This increase further underscores increasing trends in valuation when it comes to specifics.

In summary, the Stratford Township residential real estate market in December 2023 was characterized by a decrease in active listings and a stable influx of new listings.

The market is showing signs of a possible shift away from sellers, with increased days on the market and lower sale prices compared to listing prices.

The average sales price decrease and price per square foot increase, compared to last year, indicates a market that is adjusting.

Area: Harvest Villages

Western Edge of Jurupa Valley 91752

Now we turn our attention to the Harvest Villages residential area. As December 2023 comes to a close, this real estate market update report provides an overview of the current market trends and how they compare to the previous year.

The month of December saw a notable decrease in the number of active listings in Harvest Villages, with only 1 home on the market. This represents a significant drop of 66.7% compared to last year. Such a steep decline in active listings points to a much tighter market, where fewer homes are available for buyers.

Interestingly, there were no new listings this month, identical to the situation last year. The lack of new properties entering the market maintains the status quo of limited options for potential buyers.

The Months Supply of Inventory (MSI) stood at 0.8, which is 60% lower than last year. This decrease indicates that the market is clearly in favor of sellers, with fewer homes available relative to the number of buyers.

In terms of sales activity, there were 2 closed sales in December, which is a 100% increase from last year. This rise in sales, despite the low inventory, suggests that there is strong demand for homes in the Harvest Villages area.

A significant change was observed in the average days on the market. Homes now take an average of 43 days to sell, a dramatic increase of 760% from last year. This substantial increase indicates that homes are staying on the market much longer before being sold, which could be a sign of a shift in buyer behavior or a mismatch in pricing expectations.

The List to Sold Price Percentage, an indicator of how close homes are selling to their asking prices, was at 96.0%. This is a decrease of 5.9% from last year, suggesting that buyers are having more room to negotiate, and homes are selling for slightly less than their listed prices.

Using a rolling 6-month average calculation, the average sales price in Harvest Villages was $900,714 for December, showing a modest increase of 0.6% from last year. This slight uptick in the average sales price indicates a relatively stable market in terms of property values.

Lastly, determined also by using a rolling 6-month average calculation, the average price per square foot was $287, representing an increase of 9.5% from last year. This change shows an upward trend due to various factors including the types of homes sold or adjustments in the market.

In summary, the Harvest Villages residential market in December 2023 experienced a significant reduction in inventory, with a corresponding increase in closed sales.

The average days on market increased notably, suggesting a slower pace in transactions. While the average sales price saw a slight increase, the list to sold price percentage declined. The price per square foot shows an upward trend. These trends indicate a market where demand remains strong, but buyers may have more negotiation leverage.

Area: Sky Country,

Western portion of Jurupa Valley 91752

As the month of December 2023 draws to a close, the Sky Country residential area market has revealed some shifts and fluctuations worthy of note for both prospective buyers and sellers.

The active listings at the end of December stood at two properties, which is a decrease by half from the previous year. This substantial contraction in inventory is indicative of a tight market, where fewer homeowners are choosing to sell. A market such as this drives up competition among buyers for the available homes.

Interestingly, there were no new listings added this month, maintaining the status quo from the previous year. The lack of fresh listings coming to market might suggest a wait-and-see approach from potential sellers or could reflect a contentment with the current homes, further emphasizing the low-turnover nature of the area.

The months supply of inventory currently sits at 1.1, down 21.4% from last year. This reduction further illustrates a tight seller’s market, with just over a month’s supply of homes available, but still suggests a balance between current buyers’ and sellers’ market conditions.

A noteworthy uptick occurred in closed sales, which doubled from the previous year to two sales. This increase, despite the lower inventory, indicates a latent demand that is being met as properties come available.

The average days on market before sale has risen significantly to 45 days, up 350% from last year. This longer duration before sale could be due to a variety of factors, such as pricing strategies or buyers taking more time to make decisions in a market with few options.

Sellers received 98.3% of their list price, showing a slight decrease of 1.7% from last year. This small change could suggest a minor shift in negotiation power towards buyers, or simply a market settling into a new rhythm of sales activity.

The average sales price in Sky Country has seen a decrease of 3.7% to $785,889, when considering a rolling 6-month average. This decline in average sales price might reflect an adjustment in the types of homes being sold or a natural market correction.

However, the price per square foot has remained stable with a nominal increase of 0.2% to $438, indicating that while overall prices have dropped, the value attributed to the space within the homes holds steady. This could suggest a consistent or even growing appreciation for the quality and features of the homes in the Sky Country area.

In conclusion, the Sky Country residential area’s real estate market is experiencing a fascinating period of adjustment, with a drop in inventory and average sales price, but a steady valuation in terms of square footage and a sustained interest from buyers as evidenced by the closed sales.

These conditions present unique opportunities and considerations for both buyers and sellers in the market.

Area: Rancho Del Sol – Sage – Serrano Ranch area of homes,

Western portion of Jurupa Valley 91752

As we review the residential real estate market for the Rancho Del Sol-Sage-Serrano Ranch area for December 2023, several key trends and changes from the previous year emerge, painting a picture of the current state of the market.

Firstly, the number of active listings at the end of the month was 5, which is a 50% reduction from last year. This significant drop in available properties indicates a tight market, where fewer homes are available for buyers. Such a decrease in inventory can lead to increased competition among buyers and can affect overall market dynamics.

Interestingly, there were 4 new listings in December, compared to 0 a year ago. The addition of these new listings have provided some fresh options for buyers in the market.

The Months Supply of Inventory (MSI), which measures the balance between supply and demand, stood at 2.1 months. This is a 38.2% decrease from last year, indicating that the market remains favorable to sellers, with reduced inventory relative to demand.

In terms of sales, there was 1 closed sale in December, which is consistent with last year’s data. This steady state of closed sales, despite the decreased inventory, suggests that demand remains stable, but buyers may be more selective or constrained by the limited options available.

A significant change is observed in the average days on market, which is now 56 days. This is a decrease of 66.9% from last year, indicating that homes are selling faster. This acceleration in sales pace could be due to increased buyer demand or possibly more aggressive pricing strategies by sellers.

The List to Sold Price Percentage, which indicates how close homes are selling to their asking prices, was 96.0%. This is a 4.7% increase from last year, suggesting that homes are selling closer to their listed prices, indicating a sellers’ market.

The average sales price in the area was $854,667, showing an increase of 4.9% from last year. This increase, calculated using a rolling 6-month average, indicates an appreciation in property values in the Del Sol-Sage-Serrano area.

Finally, the average price per square foot was $310, a notable increase of 34.8% from last year. This significant rise reflects an increased valuation of properties in the area, which could be due to various factors like improved neighborhood amenities, demand for housing in the area, or general market trends.

In summary, the Rancho Del Sol-Sage-Serrano Ranch residential real estate market in December 2023 experienced a substantial reduction in inventory and a stable number of closed sales compared to last year.

The market is clearly in favor of sellers with faster sales, higher list-to-sold price ratios, and increased property values.

Area: Central Mira Loma (original)

Western portion of Jurupa Valley 91752

The following residential real estate market update for the original Mira Loma residential area for the month ending December 2023, aims to provide a clear and concise overview of the market dynamics based on several key indicators.

The End of Month Active Listings in the Mira Loma area was notably sparse, with only 1 listing available. This number marks a significant decrease of 85.7% from last year, reflecting a highly constrained market with limited choices for potential buyers. This scarcity of listings is a critical factor in understanding the current market conditions.

In terms of new listings, December 2023 saw no new properties entering the market, a stark 100% decrease from the previous year. This lack of new inventory further emphasizes the tightness of the market and could be influencing other market dynamics.

The Months Supply of Inventory, a vital metric indicating the balance between supply and demand, stood at a remarkably low 0.6. This figure has decreased by 82.9% compared to the same period last year, reinforcing the tight seller’s market where demand outpaces supply.

Closed Sales in the area amounted to 4 properties, compared to 0 closed properties a year ago. However, this number of sales, despite the low inventory, suggests a continued interest and activity in the Mira Loma market.

The Average Days on Market for listed properties was 56 days. This metric offers insight into the market pace, indicating that properties, on average, take less than two months to sell, which is relatively swift and reflects a market with active buyers.

A noteworthy point is the List to Sold Price percentage, which stood at an impressive 99.9%. This high percentage indicates that properties are selling for nearly their asking price, a sign of a strong market where buyers are willing to meet sellers’ price expectations.

The Average Sales Price in Mira Loma was recorded at $698,923, showing a healthy increase of 8.6% from the previous year, based on a 6-month rolling average. This rise in the average sales price highlights the area’s growing market value.

Lastly, the Average Price per Square Foot was $498, marking a 3.3% increase from last year, also calculated using a 6-month rolling average. This increase, though modest, is indicative of the overall health and upward trajectory of the property values in Mira Loma.

In summary, the Mira Loma residential real estate market for December 2023 demonstrates a market characterized by significantly reduced inventory and new listings, coupled with stable sales and increasing property values.

The market conditions suggest strong demand and a competitive environment for buyers, while sellers will find favorable conditions for selling their properties.

Understanding these dynamics is crucial for making informed decisions in this unique and evolving market.

Area: Mira Loma – South (original)

Western portion of Jurupa Valley 91752

Now we turn to the original Mira Loma-South residential real estate market update for the month ending December 2023. This report synthesizes key metrics to provide a comprehensive overview of the current market trends in this area.

To begin with, we observed a significant reduction in the End of Month Active Listings, which stood at just 1 property. This represents a dramatic 50% decrease compared to the same period last year. This reduction indicates a tight sellers’ market, with fewer options available for potential buyers.

In terms of new listings, there were no new properties introduced to the market in December 2023, consistent with one year ago.

A crucial metric to consider is the Months Supply of Inventory, which currently stands at 0.8. This low figure illustrates a seller’s market, as there is less than one month’s worth of inventory available. This condition favors sellers and can lead to competitive bidding situations for available properties.

Regarding Closed Sales, the number remained unchanged from last year, with no recorded sales in December 2023. This is attributed to the limited inventory and possibly other external market factors.

Unfortunately, we do not have data for the Average Days on Market or the List to Sold Price percentage for this period. These metrics are essential in understanding the market’s velocity and the negotiation dynamics, but their absence this month leaves a gap in our analysis.

The Average Sales Price in the Mira Loma-South area was recorded at $601,667, which is a decrease of 7.7% compared to last year. This figure has been calculated using a 6-month rolling average, providing a more smoothed and reliable indicator of pricing trends.

Lastly, the Average Price per Square Foot has seen a notable increase, standing at $453. This is an 18.6% rise from the previous year, calculated again using a 6-month rolling average. This significant increase suggests that while overall prices might be dipping, the value of the property per square foot is appreciating, indicating a potential increase in property value or changes in the types of properties being sold.

In summary, the Mira Loma-South residential real estate market in December 2023 presented a unique set of challenges and opportunities. The low inventory and absence of new listings suggest a market that is currently more favorable to sellers.

However, the decrease in average sales price coupled with an increase in price per square foot highlights the dynamic nature of the market. It’s a market where strategic pricing and understanding of current trends become crucial for both buyers and sellers.

Area: Mira Loma Village,

North-Western portion of Jurupa Valley 91752

The real estate market update for the Mira Loma Village residential area for the month ending December 2023 aims to offer a clear perspective on the current trends and conditions in the Mira Loma Village housing market.

A key feature of the Mira Loma Village market in December is the absence of active listings. This situation indicates a remarkably static market with no properties available for sale at the end of the month. Such a scenario can be attributed to various factors, including a period where homeowners are choosing not to sell.

Similarly, there were no new listings in December. This lack of fresh inventory entering the market reinforces the idea of a stagnant market in terms of new offerings. This could be a reflection of the current homeowners’ satisfaction with the area or a strategic decision to hold off on selling due to market conditions.

Regrettably, there is no available data on the Months Supply Inventory, Closed Sales, Average Days on Market, or List to Sold Price Percentage for December. This lack of information limits our ability to fully analyze the market dynamics in terms of sales activity and pricing trends.

However, we do have insightful data regarding the average sales price and average price per square foot, both calculated using a rolling 6-month average. The average sales price in Mira Loma Village is currently $597,500. This price point positions the area as a moderately-priced market within the region. Additionally, the average price per square foot stands at $453, offering a perspective on the area’s property value in terms of space.

It is also noteworthy to mention that since the beginning of the year, there have been two homes sold in Mira Loma Village. The first sale occurred in February, where a house listed for $610,000 was sold for $615,000, slightly above the asking price.

The second sale took place in August, with the property listed for $525,000 and closing at $580,000. These sales are indicative of a competitive market where homes can sell for more than their listing price, possibly due to bidding wars or high demand for properties in the area.

In conclusion, the Mira Loma Village residential market, as of December 2023, is characterized by an absence of active and new listings, suggesting a very static market environment. The average sales price and price per square foot indicate a stable market with a moderate pricing range.

For potential buyers, the current market situation poses a challenge due to the lack of available properties, whereas for sellers, it represents a potentially favorable market condition.

Area: Homestead,

North-Western portion of Jurupa Valley 91752

The December 2023 Homestead residential area market update report aims to succinctly convey the prevailing trends and shifts in the local real estate market.

A notable aspect of the Homestead market in December is the presence of 2 active listings, marking a significant 100% increase from the same period last year. This increase in active listings indicates a shift in the market, suggesting that more homeowners are now interested in selling their properties.

Contrastingly, there were no new listings in December, showing a complete downturn from last year. This lack of new inventory entering the market could be indicative of a momentary lull or possibly a more strategic decision by potential sellers based on market conditions.

The Months Supply Inventory, which provides insight into the balance between supply and demand, stands at 1.0. This figure is up by 42.9% compared to last year, suggesting a slight increase in the availability of homes relative to the demand. A low months supply inventory of 1.0 indicates a sellers’ market.

There were 4 closed sales in December, which is a substantial 300% increase from the previous year. This significant rise in closed sales indicates heightened activity in the market, suggesting an increased buyer interest or possibly more favorable conditions for transactions.

The average days on market for properties is remarkably short at just 7 days, a 53.3% decrease from last year. This rapid pace of sales suggests a highly competitive market where homes are being snapped up quickly, likely due to high demand as well as the desirability of the Homestead area.

Properties in Homestead are selling at an average of 94.0% of their listed price, which is a decrease of 6.0% from the previous year. This change could indicate a shift towards a buyer’s market, where buyers have slightly more leverage in negotiations, or it could reflect a more realistic pricing strategy by sellers.

The average sales price in Homestead is $559,113, marking a 3.2% increase from the previous year. This rise, calculated using a rolling 6-month average, suggests a steady appreciation in property values, potentially driven by the area’s appeal and overall market conditions.

Additionally, the average price per square foot now stands at $426, up by 1.2% from last year. This metric was also calculated using a rolling 6-month average. This increase, albeit modest, points towards a stable valuation in terms of property space, which is a positive indicator for both buyers and sellers considering the market dynamics.

In summary, the Homestead residential market as of December 2023 is characterized by a notable increase in active listings and a significant rise in closed sales, coupled with a rapid average selling time. The slight increase in average sales price and price per square foot indicates a healthy and appreciating market.

These conditions present opportunities for both buyers and sellers.

***

As a real estate broker, understanding the nuanced market shifts in the above residential area market update reports is key to providing informed advice and strategy to sellers throughout the 91752-zip code area.

For a comprehensive understanding of how the trends above can impact your real estate decisions, contact me. I provide expert guidance and strategic insights and can guide you through these interesting times in real estate.

Manny Barba

Broker-Attorney-Realtor®

951-990-3998

MB Live Realty, Inc.

Note: All data in this report is from California Regional Multiple Listing Service (CRMLS) All information should be independently reviewed and verified for accuracy. This report is for informational purposes only and not intended as financial or investment advice.

No Comments