Mortgage Rates Stay Resilient

This week, the focus was on Friday’s jobs report because it can affect mortgage rates. The report showed that the number of jobs added was higher than expected, and the unemployment rate also decreased slightly to 3.7% from 3.9%.

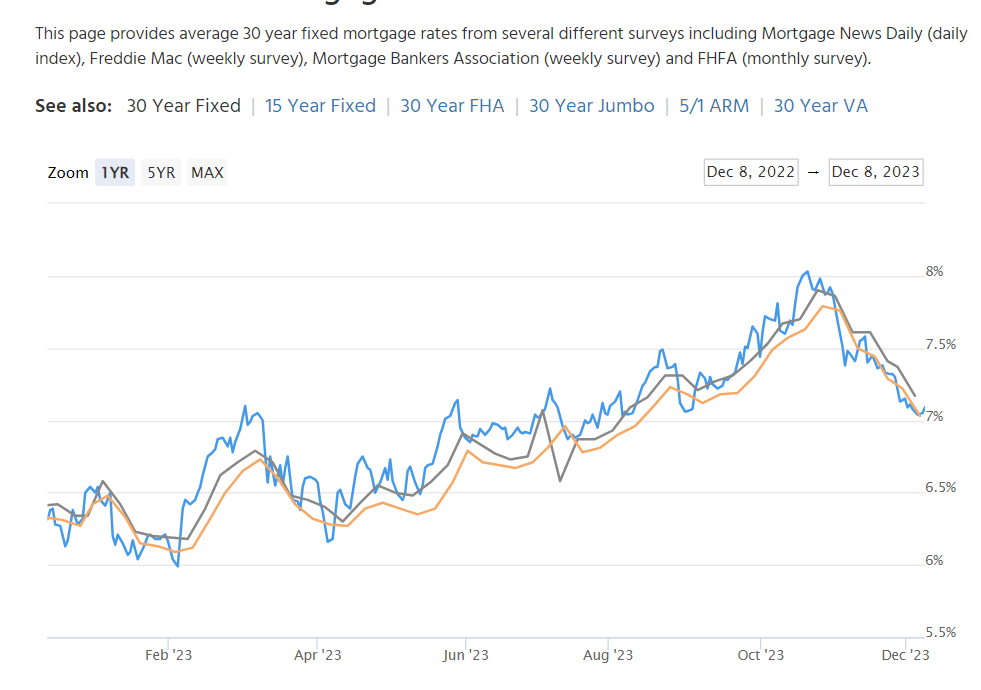

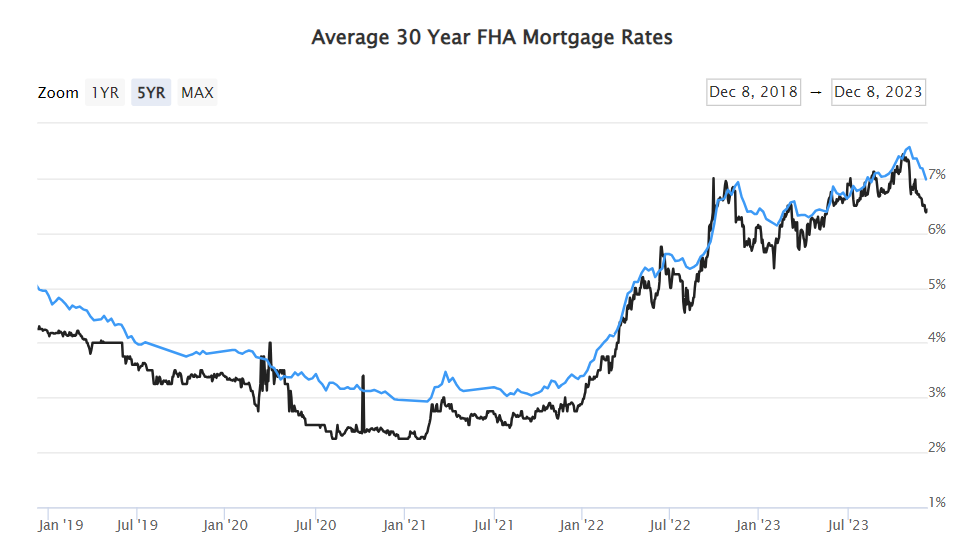

The report was good and rates went up, but not as much as the industry thought they would. Most people won’t see a big change in rates from las week, with average rates still around the low 7s for best-case scenarios.

Strong job market data usually means higher rates. This is because a strong economy can lead to more inflation, and inflation is bad for interest rates.

Now the financial industry is looking forward to next Tuesday’s Consumer Price Index (CPI) report, which measures inflation. This report is just as important as the jobs report for interest rates.

Later next week the Federal Reserve (Fed) will release new rate forecasts. Even though the Fed didn’t change rates this time, financial markets will closely look at these forecasts to guess how the Fed’s plans might change in 2024.

The bottom line is mortgage rates have been trending downward, which is a good thing. Let’s see if that trend continues.

Manny Barba

Broker-Attorney-Realtor®

951-990-3998

mail@mbliverealty.com

MB Live Realty, Inc.

www.mbliverealty.com

No Comments