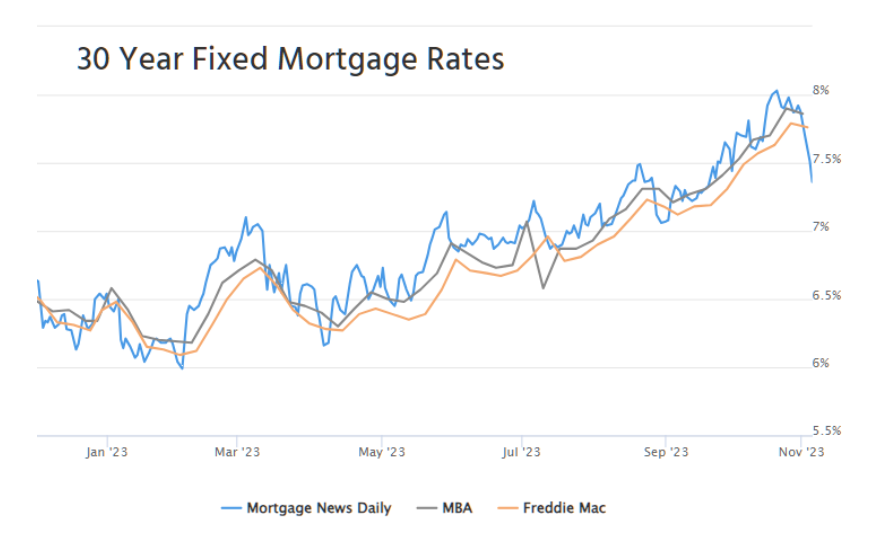

From 8% to Under 7.5% – Are Mortgage Rates Dropping?

Just a couple of weeks ago, on October 19th, the average rate for a 30-year mortgage was over 8%. At the beginning of this week, it hadn’t improved much and was at 7.92%.

But things have really changed in the last three days of the week, especially from Wednesday to Friday. The rates have dropped so much during these days, it’s the biggest decrease we’ve seen in more than 10 years. If we ignore the crazy changes from March 2020, when the pandemic started, we only saw something similar happen once before, in early November last year.

You might think this is a regular thing that happens around this time of year, but it’s not that simple. Both times,

rates went up, and then some unexpected good news came out. Last November, for example, the Consumer Price Index, which is a way to measure inflation, showed things might be getting better. But that hope didn’t last, and rates kept going down until February 2023. After that, they started going up again.

This week, the drop in rates started on Wednesday when the government said it would sell fewer bonds than expected. This is good for mortgage rates because when the government sells fewer bonds, rates usually go down.

On Thursday, the rates kept dropping because more people were claiming jobless benefits than expected, and some traders stopped betting that rates would go up. In the bond market, when traders stop expecting higher rates, they’re essentially betting on rates going down.

In addition, Friday’s job report was important. If it showed more jobs than expected, it would mean the rates dropped too quickly. But instead, the report showed fewer jobs, a higher unemployment rate, and that some job gains in the past months were not as good as we thought. The job market is still strong, but not as strong as what was priced in the rates. Friday’s job numbers suggest things are cooling down to more normal levels.

I can’t say for sure what’s going to happen in the future, but what I do know is that this has been one of the best three-day periods for mortgage rates and bonds in a long time since they started going up two years ago. The fact that rates were high recently probably helped the rates to fall more easily. But the downward trend is still good news.

The average 30-year fixed mortgage rate for the most credit-worthy scenarios is now below 7.5%. You’ll see different rates depending on the lender, especially now and early next week. With all this change, some lenders can offer rates in the high 6% range if you pay upfront fees, while others are still around 8%.

Remember, the rates I am talking about are for perfect situations, and not everyone has a perfect situation. The best way to use this information is to compare it to a rate you already know or a standard starting point to track changes.

Bottom Line: a downward trend for mortgage rates is a good thing.

Manny Barba,

Broker-Attorney-Realtor®

MB Live Realty, Inc.

No Comments