Mortgage Rates Stay At Recent Low Levels

Mortgage Rates Stay At Recent Low Levels

The average mortgage lender remained close to their lowest levels of the past 2 months by the end of this past Friday with almost no change. That’s a departure from the recent trend of larger movements, but also an expected shift given the absence of big-ticket economic data.

“Big ticket” data refers to the scheduled economic reports like the Consumer Price Index (CPI) which was responsible for the largest portion of this week’s improvement and Retail Sales which pushed back in the other direction the following day.

Also, Retail Sales data did not spoil the much needed lower interest rates this week. The next data with the power to help or hurt in any major way won’t arrive until the first full week of December. In the meantime, the baseline scenario is for lower volatility in a more lateral trend.

However, Thanksgiving week can occasionally see very random volatility that is not connected to underlying events or data. This is a byproduct of the less than vigorous trading environment on major holiday weeks. So stay tuned to see where rates go after the holiday week.

30 Year Fixed Mortgage Rates

The graph below provides average 30 year fixed mortgage rates from several different surveys including Mortgage News Daily (daily index), Freddie Mac (weekly survey), Mortgage Bankers Association (weekly survey) and FHFA (monthly survey).

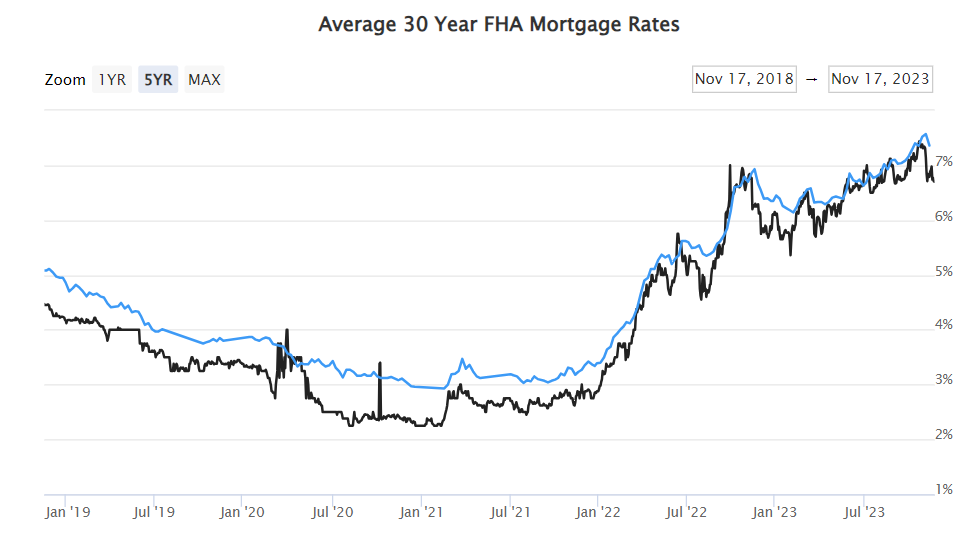

30 Year FHA Mortgage Rates

The graph below provides average 30 year FHA mortgage rates from Mortgage News Daily (daily index) and the Mortgage Bankers Association (weekly survey).

Based on the data I have reviewed in the past month, I predict mortgage rates will continue on a slow downward trend.

Manny Barba,

Broker-Attorney-Realtor®

MB Live Realty, Inc.

No Comments