91752 Residential Real Estate Market Update (Jurupa Valley-Eastvale) – February 2024

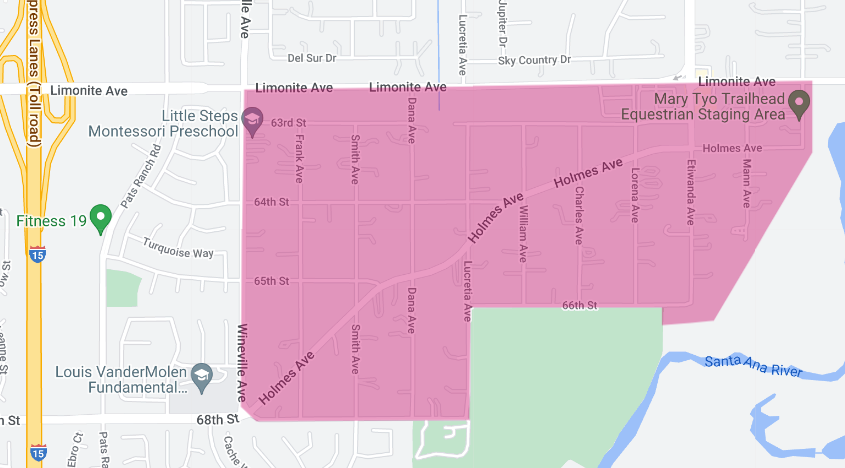

The 91752-zip code, located in Riverside County, California, encompasses a small part of Eastvale (east of Hamner Avenue) and the western part of Jurupa Valley (Mira Loma area). The history of the ’52 zip code is closely tied to the development of these communities. Here’s a brief overview:

Throughout the 19th and early 20th centuries, the area was predominantly agricultural. It was known for its dairy farms and fields of crops, which benefited from the region’s fertile soil and favorable climate.

After World War II and into the 20th century, the region began to transform like many areas in Southern California. The growth of the Los Angeles metropolitan area, transportation improvements, and the increasing demand for suburban housing led to the development of residential communities, eventually becoming the cities of Eastvale and Jurupa Valley.

Today, the 91752-zip code is characterized by its suburban residential communities, commercial developments, and remaining agricultural areas. It reflects the more significant trends in Southern California’s Inland Empire – a shift from rural to suburban and urban landscapes.

The history of the 91752-zip code is a microcosm of the broader changes in Southern California – from indigenous lands to agricultural heartland to a thriving suburban area. It reflects the dynamic and ever-evolving nature of the region.

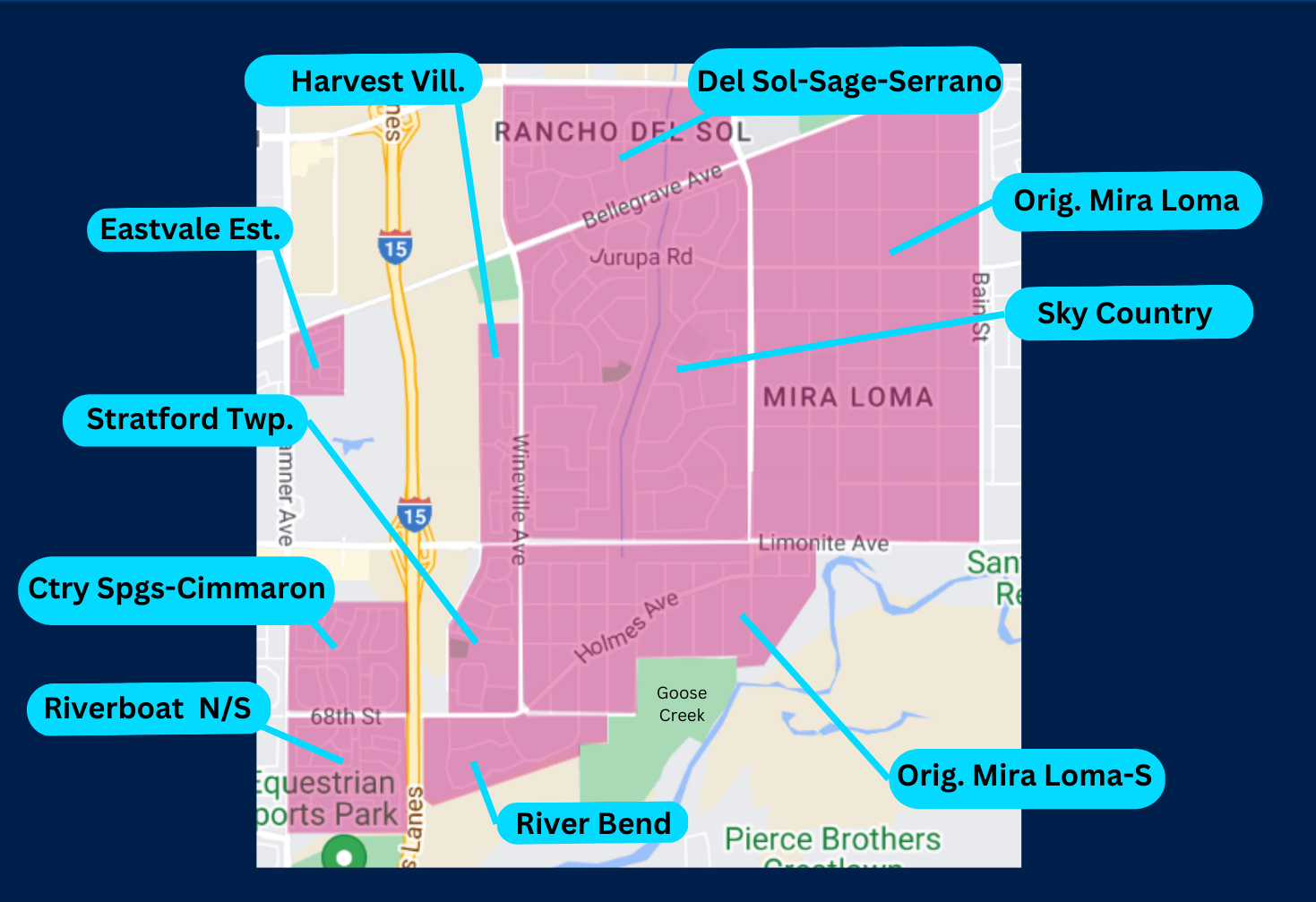

The following data is not intended to be a comparative market analysis for any one particular home but instead gives a general valuation for homes in each of the 12 specified areas and the entire residential areas located in the 91752-zip code.

For a detailed and personalized market analysis of your home, or if you have any questions, please get in touch with me.

Manny Barba,

Broker-Attorney-Realtor®

DRE #00879806

951-990-3998

mail@mbliverealty.com

MB Live Realty, Inc.

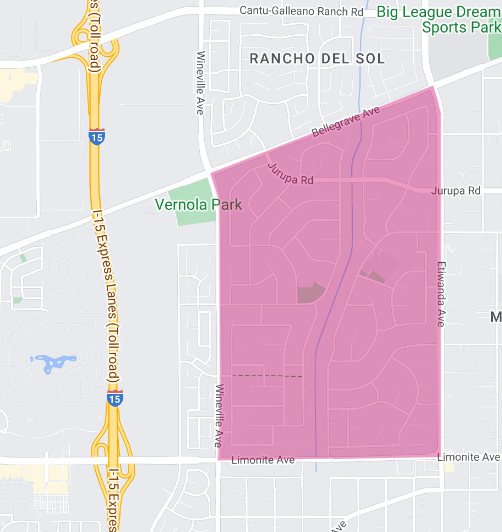

Area: Rancho Del Sol-Sage Pointe-Serrano Ranch area of homes,

(Western portion of Jurupa Valley 91752 )

As we close the books on February 2024, the Rancho Del Sol-Sage-Serrano Ranch residential area presents a unique picture of the local real estate market, marked by significant shifts and trends worth noting for homeowners and potential buyers alike. This report aims to provide a comprehensive overview of the current state of the market, reflecting on key metrics and their implications.

The most striking observation this month is the significant reduction in active listings, which have halved compared to the same period last year, standing now at just four properties. This stark 50.0% decrease underscores a tight market where options for buyers are notably limited.

Concurrently, the introduction of new listings to the market has also seen a substantial decline, with only one new property listed, representing a 66.7% decrease from the previous year. This scarcity in new listings further contributes to the competitive nature of the current market environment.

Despite the reduced inventory, the market’s dynamics suggest a robust demand, as evidenced by the closed sales for the month. With three properties sold, there’s a notable 50.0% increase in closed sales compared to last year, indicating that despite fewer options, properties that do come onto the market are moving quickly.

This demand is further highlighted by the average days on market for sold properties, which now stands at 42 days. This marks a 23.6% decrease from last year, suggesting that properties are selling more rapidly, a trend that is beneficial for sellers seeking to close transactions swiftly.

Financially, the market remains relatively stable yet shows signs of growth. The list-to-sold price percentage slightly declined by 0.4% from last year to 98.1%, indicating that while properties are selling close to their asking prices, buyers may find a small but notable negotiating space. The average sales price has seen a modest increase of 0.6% from last year, reaching $806,667. This gentle uptick in sales price points to a market that is maintaining its value, with potential for growth.

A standout metric this month is the average price per square foot, which has surged by 33.9% to $316. This significant increase is a clear indicator of the market’s strength and the high value placed on residential property within the Rancho Del Sol-Sage-Serrano Ranch area.

Lastly, the months’ supply of inventory, sitting at 1.9, has decreased by 26.9% from the previous year. This reduction reflects a market where demand continues to outpace supply, leading to a competitive environment for buyers.

In summary, the Rancho Del Sol-Sage-Serrano Ranch residential market is experiencing a period of intense competition, with a significant reduction in available and new listings. Despite this, the market is dynamic, with properties selling faster and at prices that are gradually increasing.

For potential buyers, the current market conditions suggest the importance of decisiveness and preparedness in a competitive environment. For sellers, the market offers a favorable context to list properties, with the potential for quick sales at values close to or exceeding the asking price.

As we move forward into 2024, it will be interesting to observe how these trends evolve and shape the local real estate landscape.

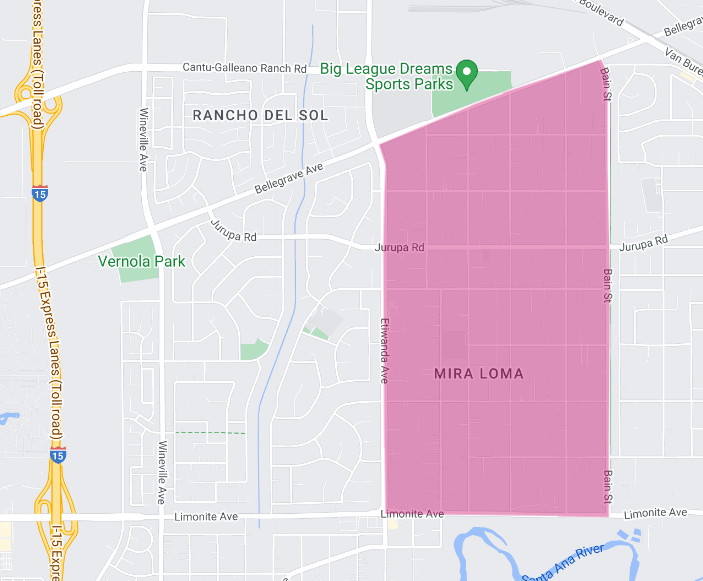

Area: Central Mira Loma (original)

(Western portion of Jurupa Valley 91752)

In February 2024, the housing market in the original Mira Loma neighborhood went through a drought of inventory affecting the sale of homes. This report delves into the metrics for the month, providing insights into the current state of the market and potential implications for stakeholders.

This month, the market saw no active listings, marking a drastic 100.0% decrease from the previous year. This absence of listings is a rare occurrence, reflecting a stagnant market where neither buyers nor sellers are active.

Similarly, there were no new listings introduced to the market, a situation mirroring the lack of active listings and further emphasizing the current standstill in market activity.

Given the absence of listings, it’s not surprising that there is no available data on the months’ supply of inventory. This metric, which helps gauge the balance between supply and demand, cannot be calculated without active or new listings, leaving us without a clear picture of market dynamics from this perspective.

The lack of market activity extends to closed sales as well, with no transactions completed during the month. This represents a 100% decline from the previous year, indicating a complete halt in sales activities. Consequently, there are no data points for average days on market or list to sold price percentage, as these metrics rely on the occurrence of closed sales to be measured.

Despite the current inactivity in listings and sales, the market’s valuation metrics tell a different story. The average sales price, calculated using a rolling 3-month average, stands at $692,000. This figure represents a notable 16.5% increase from last year, suggesting that while immediate market activity has ceased, the value of properties within the area has grown.

Similarly, the average price per square foot has seen a significant increase of 27.1%, reaching $492. This increase is based on a rolling 3-month average and indicates a substantial appreciation in property values.

The divergence between the current market activity (or lack thereof) and the valuation metrics highlights a complex scenario. On the one hand, the absence of active and new listings, coupled with no closed sales, paints a picture of a market at a standstill. On the other, the appreciation in property values suggests underlying demand and a potential for future market activity once listings resume.

For homeowners in the original Mira Loma area, this report underscores the latent value in their properties, evidenced by the increase in the average sales price and price per square foot.

For potential buyers, the current lack of listings presents a challenge, but also an opportunity to anticipate future listings in an area where property values are appreciating.

As the market navigates through this unique phase, stakeholders will need to stay informed and adaptable to shifts in market dynamics.

Area: Sky Country,

(Western portion of Jurupa Valley 91752 )

In the latest residential real estate market update for the Sky Country area, covering the month ending February 2024, we observed a mix of stability and subtle shifts that reflect the nuances of our local market dynamics. This report aims to provide a detailed analysis of these trends, offering insights for both potential buyers and sellers navigating the Sky Country real estate landscape.

Starting with the inventory levels, the end-of-month active listings remained unchanged from the previous year, with three properties available on the market. This stability in inventory suggests a balanced market where neither buyers nor sellers have a distinct advantage.

However, the new listings have seen a significant decrease, with just one new property introduced to the market, marking a 50.0% decline from the year before. This reduction in new listings could indicate a cautious stance from potential sellers, possibly waiting for more favorable market conditions.

The months’ supply of inventory, which provides an indication of the balance between supply and demand, stood at 1.6 months. This represents a 23.1% increase from the previous year, hinting at a slight shift towards a market that could favor buyers slightly more than in the past. However, with such a low inventory level, the market remains competitive, especially for well-positioned properties.

In terms of sales activity, the Sky Country area recorded one closed sale, consistent with the number from a year ago. This stability in sales volume indicates a steady demand for homes in the area, despite the fluctuations in other metrics.

A remarkable figure from this month’s report is the average days on market, which dropped to zero. This dramatic 100.0% decrease from the previous year suggests that the property sold in February did so immediately upon listing. This is an exceptional situation, likely reflecting either a highly desirable property or a market where demand outstrips supply to a significant extent.

Financially, the Sky Country market showed a slight variation in sales price metrics. The list-to-sold price percentage increased to 104.9%, up 1.4% from the previous year, indicating that, on average, homes sold for nearly 5% above their listing price. This trend signifies a competitive market environment where bidding wars or aggressive pricing strategies might be more common.

The average sales price experienced a minor adjustment, decreasing by 0.3% to $789,250, when calculated using a rolling 3-month average. This slight dip contrasts with the robust competition suggested by other indicators, possibly reflecting a mix of property types sold or specific market conditions affecting sale prices.

Lastly, the average price per square foot saw a modest increase of 0.7% to $444, reinforcing the notion that, despite slight fluctuations in sales prices, the overall value of real estate in the Sky Country area continues to hold steady or grow incrementally.

In summary, the Sky Country residential real estate market for February 2024 showcases a landscape of stability with underlying competitive currents. The unchanged active listings, combined with a decrease in new listings and a stable sales volume, paint a picture of a market that is navigating through a period of cautious optimism.

The significant decrease in average days on market and the increase in the list-to-sold price percentage highlight the competitive nature of transactions, suggesting that well-prepared buyers and sellers can find opportunities for successful outcomes in the Sky Country area.

As we move forward, these trends will be crucial for understanding the evolving dynamics of our local real estate market.

Area: Mira Loma – South (original)

(Western portion of Jurupa Valley 91752)

In our latest market update for the Mira Loma-South residential area for February 2024, we delve into the current state of the real estate market, highlighting key trends and metrics that define the local landscape. This report aims to provide a clear overview for both potential buyers and sellers, offering insights derived from the latest data.

Starting with the inventory levels, the end-of-month active listings in the Mira Loma-South area remained steady at one property, mirroring the figure from the previous year. This consistency in available inventory indicates a stable market in terms of new properties entering the market, with no new listings introduced this month. Such stability in inventory levels suggests that market dynamics in terms of supply have not significantly shifted over the past year.

The months’ supply of inventory stands at 0.8, which is unchanged from the previous year. This metric indicates a relatively low supply of homes relative to demand, pointing towards a market that could potentially favor sellers due to the scarcity of available properties.

However, it’s important to note the absence of closed sales this month, a significant departure from the previous year’s activity, marking a 100% decrease. This lack of sales activity provides no data for average days on market and list to sold price percentage, leaving a gap in our understanding of the current market’s pace and negotiation dynamics.

On the pricing front, the average sales price in the Mira Loma-South area has seen a decline, standing at $647,800, which represents an 11.2% decrease from the previous year, calculated using a 12-month rolling average.

This reduction in average sales price is mirrored by a 13.1% decrease in the average price per square foot, now at $397, according to the same 12-month rolling average calculation. These figures suggest a downward adjustment in property values, which could be attributed to various factors including market conditions, buyer preferences, or specific characteristics of the properties sold within the area.

Despite the unchanged supply metrics, the notable decrease in closed sales and the adjustments in pricing dynamics highlight a complex market environment.

The decline in average sales price and price per square foot may offer opportunities for buyers looking to enter the market, potentially getting more value for their investment compared to the previous year. For sellers, the stable inventory levels yet decreased valuation suggest the need for realistic pricing and market positioning to attract potential buyers in a competitive landscape.

In conclusion, the Mira Loma-South residential area’s real estate market in February 2024 presents a mixed picture. With stable inventory levels but no sales activity and a downward trend in pricing, stakeholders in the market are navigating through a period of adjustment.

For both buyers and sellers, understanding these trends and adjusting strategies accordingly will be key to achieving their real estate goals in the current market climate.

As we move forward, keeping a close eye on market developments will be crucial for making informed decisions in the Mira Loma-South residential area.

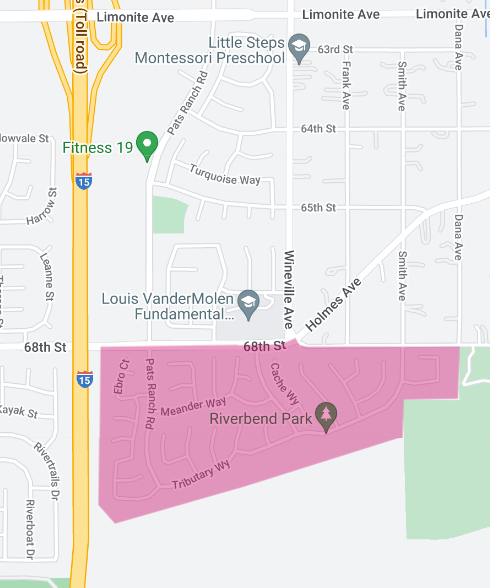

Area: River Bend Homes

(Western Edge of Jurupa Valley 91752)

In the River Bend residential area, the real estate market update for February 2024 showcases notable trends and shifts that are critical for understanding the current dynamics. This report provides a comprehensive overview of the market’s performance, highlighting the key metrics and their implications for both buyers and sellers.

The inventory landscape experienced a significant transformation with the end of month active listings doubling from the previous year to two properties. This 100% increase in active listings, although from a low base, indicates a potential easing in the market’s tightness, offering more options for prospective buyers.

In terms of new listings, the market remained consistent with the previous year, introducing one new property to the market. This steadiness in new listings suggests a level of continuity in the willingness of homeowners to sell, despite the broader changes in market conditions.

The months’ supply of inventory saw a substantial increase, rising by 120% to 1.1 months. This increase significantly outpaces the growth in active listings, indicating a shift towards a market that is slightly more favorable to buyers than in the previous year. However, the supply still remains tight, indicating that the market is far from oversaturated.

Sales activity, however, has seen a downturn, with closed sales halving from the year before, totaling just one sale. This decrease could be indicative of a variety of factors, including possible shifts in buyer demand or the impact of the increase in inventory levels on sales velocity.

The average days on the market saw a dramatic increase to 66 days, up 164% from the previous year. This substantial rise suggests that properties are taking longer to sell, potentially due to more discerning buyers or mismatches between listing prices and buyer expectations.

Financially, the market has shown mixed signals. The list to sold price percentage rose significantly to 102.8%, a 8.2% increase from last year, indicating that properties are selling for more than their listing price, on average. This could be a sign of competitive bidding on the available properties, despite the slower sales pace.

The average sales price in River Bend saw a moderate increase of 3.7% from the previous year, reaching $873,667, as calculated using a rolling 3-month average. This growth, albeit modest, suggests an upward trend in property values in the area.

Conversely, the average price per square foot experienced a decline of 14.4%, settling at $292. This decrease contrasts with the rise in the average sales price, possibly reflecting a change in the mix of properties sold, such as larger homes selling for more but at a lower price per square foot.

In summary, the River Bend residential real estate market in February 2024 presents a nuanced picture. With an increase in active listings and inventory supply, the market appears to be shifting slightly in favor of buyers. However, the significant increase in the average days on the market, combined with a drop in closed sales, suggests a cooling in transaction activity.

Despite these trends, the financial indicators of list-to-sold price percentage and average sales price point to a market that retains its value, albeit with some adjustments in pricing dynamics.

For stakeholders in the River Bend area, these trends underscore the importance of strategic pricing and marketing to align with the evolving market conditions.

Area: Riverboat Dr. Area Homes

(Western Edge of 91752 ZIP Code, Eastvale, CA)

In our latest market update for the residential area adjacent to Riverboat Drive, both to the north and south, we’ve observed a mix of stability and change that paints a unique picture of the current real estate climate as of February 2024. This report aims to distill the essential trends and metrics from this period, providing clear insights into the market’s direction for potential buyers and sellers alike.

A notable change has occurred in the inventory levels, with the end-of-month active listings decreasing to just one property, marking a significant 66.7% drop from the previous year. This reduction in available properties signals a tighter market, potentially increasing competition among buyers for the limited inventory.

Despite this sharp decrease in active listings, new listings have held steady with one new property entering the market, unchanged from the previous year. This steadiness in new listings suggests a level of consistency in homeowner willingness to sell, despite the overall reduction in inventory.

The months’ supply of inventory, standing at 0.8 months, has experienced a substantial 60.0% decrease from last year. This decrease further emphasizes the tightness of the market, indicating a quicker pace of sales relative to the number of homes available, which could lead to a competitive environment for buyers.

In terms of sales activity, there were no closed sales reported this month, consistent with the previous year. The absence of sales activity provides no data for average days on the market and list-to-sold price percentage, leaving a gap in our understanding of the current market’s transaction dynamics.

Financially, the market has seen mixed signals. The average sales price has experienced a slight decline, down 1.7% from the previous year to $885,000, as calculated using a rolling 3-month average. This slight decrease in the average sales price may reflect adjustments in market valuation or shifts in the types of properties being sold.

Conversely, the average price per square foot has seen an 8.1% increase from last year, reaching $281. This increase suggests that, while the overall sales price has seen a slight decline, the value of property per square foot has grown, potentially indicating a demand for quality over quantity or a shift in the market towards higher-value, smaller properties.

In summary, the residential area adjacent to Riverboat Drive is navigating through a period of tight inventory and stable new listings, with no sales activity reported for the month.

The decrease in active listings and months’ supply inventory highlights a competitive market landscape, possibly pushing prices and demand in various directions.

The mixed financial indicators, with a slight decrease in average sales price but an increase in price per square foot, suggest nuanced market conditions that both buyers and sellers must navigate carefully.

As we move forward, these trends will be crucial in shaping strategies for those looking to participate in this unique market segment.

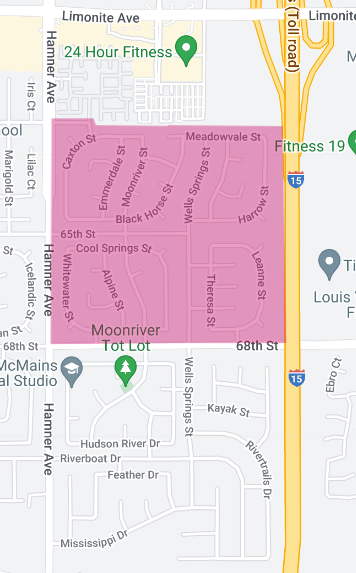

Area: Country Springs/ Cimmaron Ranch

(Western Edge of 91752 ZIP Code, Eastvale, CA)

As we assess the real estate market for the Country Springs-Cimmaron Ranch area for February 2024, we find ourselves in a unique situation. The market activity for this month presents a set of challenges for analysis due to an absence of active listings and sales.

The end-of-month active listings stand at zero, which is a complete reduction from last year—a 100.0% change. Similarly, there are no new listings, which again represents a 100.0% decrease from the previous year. This complete lack of inventory indicates that the market is currently stagnant, with no immediate opportunities for potential buyers or sellers.

Given the absence of any active or new listings, we are unable to provide data on the months’ supply of inventory. This metric typically helps to gauge whether we are in a buyer’s or seller’s market by estimating how long it would take to sell through the current inventory at the present rate of sales. However, without any inventory or sales, such an analysis is not possible at this time.

There were also no closed sales this month, which aligns with the data—or lack thereof—from the previous year. Consequently, we do not have data for the average days on market or the list to sold price percentage. These indicators are vital to understanding market dynamics, such as how quickly homes are selling and how final sale prices compare to listing prices, but they cannot be measured without sales activity.

Despite the absence of recent sales, we can report on the average sales price and the average price per square foot based on a rolling 3-month average. The average sales price remains at $875,000, showing no change from the previous year. The average price per square foot also stands steady at $281, again showing no year-over-year change. These figures suggest that, while there has been no recent activity, the valuations from the previous sales period have remained stable.

In summary, the Country Springs-Cimmaron Ranch residential area has experienced a period of inactivity with no listings or sales reported for the month of February 2024. For potential sellers, this could indicate a pause in market activity, possibly due to seasonal fluctuations or broader economic factors.

For buyers, the current lack of available properties means there may be pent-up demand once listings do appear on the market. Monitoring the market closely for signs of activity will be crucial for those interested in this area. Should the market reactivate, both buyers and sellers will need to be prepared to act quickly and decisively in response to new listings or changes in market conditions.

Area: Stratford Township Homes

(Western Edge of Jurupa Valley 91752)

As we review the residential real estate market for Stratford Township for the month ending February 2024, we find a market experiencing notable shifts that have implications for both potential buyers and sellers. This report seeks to unpack the nuances of these changes, providing a clear and comprehensive overview of the current market dynamics.

The inventory of active listings has seen a significant reduction, with the end of month active listings standing at two properties. This represents a 50.0% decrease from the previous year, indicating a tightening of available inventory for potential buyers. The reduction in inventory is a critical factor that can influence market dynamics, potentially leading to increased competition for available properties.

In a stark contrast to the previous year, there were no new listings introduced to the market this month, marking a 100.0% decrease. The absence of new listings further contributes to the constrained inventory levels, potentially impacting buyer choice and market fluidity.

The months’ supply of inventory, which measures how long the current inventory of properties would last at the current rate of sales if no new listings were added, stands at 1.3 months. This represents a significant 59.4% decrease from the previous year, highlighting a market that is moving towards becoming more competitive and possibly seller-favorable due to the limited inventory.

Notably, there were no closed sales reported this month, a stark contrast to the previous year and a shift that underscores a pause in transactional activity. The lack of closed sales prevents us from providing data on average days on market and list to sold price percentage, key indicators that help understand market velocity and negotiation dynamics.

Financially, the market has shown mixed signals. The average sales price has experienced a downturn, standing at $755,000, which is a 5.9% decrease from the previous year. This decline in average sales price, calculated using a rolling 3-month average, could reflect various factors including changes in the types of properties sold, buyer preferences, or overall market adjustments.

Conversely, the average price per square foot has seen an increase, rising by 8.7% to $299, according to a rolling 3-month average calculation. This increase in price per square foot, despite the decrease in the average sales price, suggests that while overall prices have dipped, the value attributed to the space within these properties has grown, possibly indicating a shift towards smaller, but more valuable properties.

In summary, the Stratford Township residential real estate market in February 2024 presents a landscape of decreased inventory and a pause in sales activity, coupled with mixed financial indicators. The significant reduction in both active and new listings points to a tightening market, while the absence of sales activity highlights a potential period of recalibration for the market.

The decrease in average sales price juxtaposed with an increase in price per square foot suggests nuanced changes in market preferences and property values.

For stakeholders in the Stratford Township area, understanding these trends will be vital in navigating the current market, whether looking to buy, sell, or invest in the local real estate landscape.

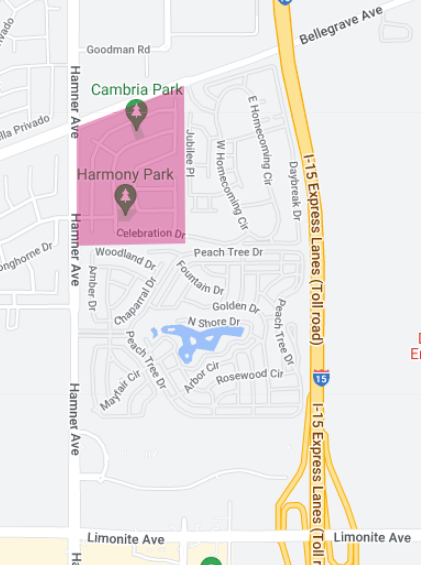

AREA: Eastvale Estates (Bellegrave Ave./Hamner Ave/)

(Western Edge of 91752 ZIP Code, Eastvale, CA)

In the Eastvale Estates residential area, the real estate market report for February 2024 reveals a unique situation that presents both challenges and opportunities for market participants. This narrative seeks to provide a detailed analysis of the current state of the market, utilizing the latest metrics to offer insights for buyers, sellers, and investors alike.

This month, Eastvale Estates has experienced a significant shift, notably with the end of month active listings dropping to zero. This 100% decrease from the previous year indicates a complete absence of inventory, a rare occurrence that dramatically impacts market dynamics. The lack of new listings, which also stands at zero, underscores this trend, suggesting a market with no movement in terms of properties being offered for sale.

Given the absence of inventory, the concept of a months’ supply of inventory becomes inapplicable, as there are no properties available to calculate the rate at which sales could potentially occur. This situation creates a unique market condition where traditional metrics of supply and demand cannot be directly applied.

Sales activity mirrors this trend, with closed sales also reported at zero, unchanged from the previous year. The absence of closed sales further contributes to the lack of data for average days on market and list to sold price percentage. Without transactions occurring, these metrics, which typically provide insight into the pace of the market and negotiation dynamics, cannot be assessed.

Financially, the market presents a static picture, with the average sales price standing at $800,000. This figure, calculated using a rolling 6-month average, remains an important indicator of the market’s valuation over a more extended period, despite the current stagnation in sales and listings.

Similarly, the average price per square foot is reported at $342, offering a measure of value that persists even in the absence of active market transactions.

In summary, the Eastvale Estates residential market for February 2024 is characterized by an unprecedented lack of activity, with no active listings, new listings, or closed sales.

This stagnation presents a challenging environment for market participants, with traditional dynamics of buying and selling being temporarily on hold. However, the maintained average sales price and price per square foot indicate underlying value in the area’s properties, suggesting that when the market does reactivate, it will continue to be a valuable area for residential real estate.

For stakeholders, this period may be a time for strategic planning and preparation, with a focus on monitoring the market for signs of reactivation.

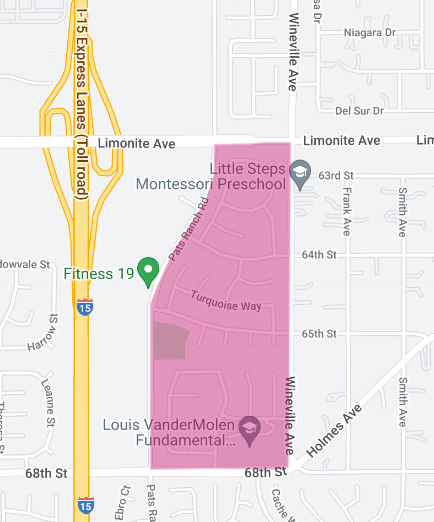

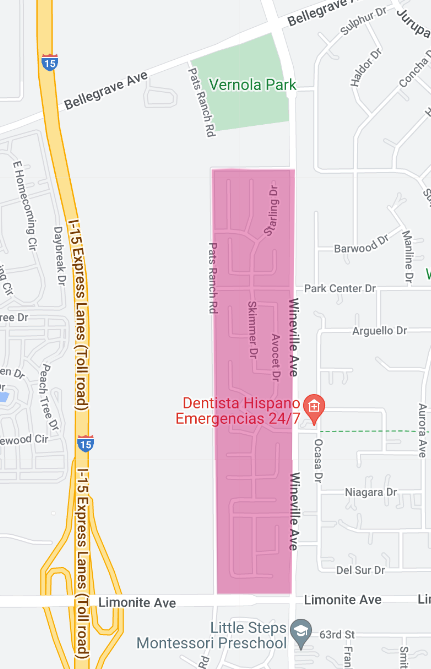

Area: Harvest Villages at Vernola Ranch

(Western Edge of Jurupa Valley 91752)

In this month’s residential real estate market update for the Harvest Villages area, we delve into the dynamics and trends that have shaped the market as of February 2024. The report aims to provide a nuanced understanding of the local real estate landscape, offering insights that are valuable to both buyers and sellers.

The end of month active listings in the Harvest Villages area stands at one, marking a significant 50.0% decrease from the previous year. This reduction in active listings reflects a tighter market, with fewer options available for potential buyers. The scarcity of listings could lead to increased competition for available properties, potentially influencing market dynamics in favor of sellers.

Despite the decrease in active listings, the number of new listings remained unchanged from the previous year, with no new properties introduced to the market this month. This stagnation in new listings contributes to the ongoing tightness in the market, as the supply of properties fails to meet potential buyer demand.

The months’ supply of inventory, an important indicator of market balance, stands at 0.8 months. This represents a 42.9% decrease from the previous year, further highlighting the scarcity of available properties relative to demand. Such a low months’ supply of inventory indicates a market that leans heavily in favor of sellers, where buyers may face competition and have to make quick decisions.

In terms of sales activity, there were no closed sales reported this month, consistent with the previous year. The lack of sales activity provides no data for average days on the market and list to sold price percentage, leaving a gap in our understanding of the pace of transactions and negotiation dynamics within the market.

Financially, the market has shown signs of growth despite the lack of sales activity. The average sales price has increased 8.1% from the previous year, reaching $837,500, as calculated using a rolling 3-month average. This increase in the average sales price suggests that the value of properties in the Harvest Villages area continues to rise, potentially reflecting the quality of available properties or a general upward trend in the local real estate market.

Conversely, the average price per square foot has experienced a slight decline, down 1.1% from last year to $272, according to a rolling 3-month average calculation. This minor decrease in price per square foot, juxtaposed with the increase in the average sales price, may indicate variations in the size or type of properties being valued in the market, or possibly slight adjustments in market valuation.

In summary, the Harvest Villages residential real estate market in February 2024 is characterized by a significant decrease in active listings, stable new listings, and a marked decrease in the months’ supply of inventory, suggesting a market that is becoming increasingly competitive and skewed in favor of sellers.

The increase in the average sales price, alongside a slight decrease in price per square foot, indicates a complex market where values are generally on the rise, despite some fluctuations in pricing dynamics.

For individuals looking to navigate the Harvest Villages real estate market, these trends underline the importance of timely decision-making and strategic planning, whether buying or selling, in a market with limited inventory and rising property values.

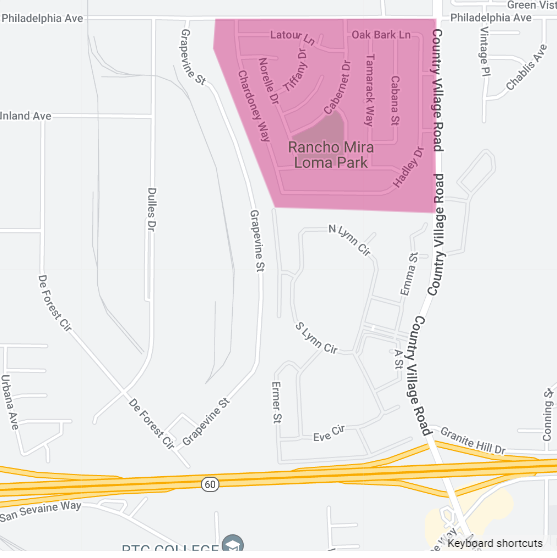

Area: Mira Loma Village,

(North-Western portion of Jurupa Valley 91752)

This report provides a detailed market update for the Mira Loma Village residential area as of the end of February 2024. Despite the static nature of some metrics, the underlying data from the past year offer valuable insights for potential buyers and sellers in the area.

As we look at the current state of the market, it’s notable that there were no active listings at the end of the month, maintaining the status quo from the previous year. Similarly, no new listings were introduced to the market, indicating a period of stagnation in terms of new inventory becoming available. This lack of inventory movement suggests a potential bottleneck for buyers waiting for new opportunities and for sellers considering entering the market.

The months’ supply of inventory also reflects this status, with no inventory available, which is consistent with the lack of active and new listings. This scenario underscores a tight market condition where demand may potentially exceed supply, although the absence of closed sales in the current period makes it challenging to gauge immediate demand accurately.

Interestingly, despite the apparent standstill in market activity—with no closed sales reported for the period and, consequently, no data on average days on market or list to sold price percentage—the rolling averages for sales price and price per square foot provide a broader perspective on market values.

The average sales price, calculated using a rolling 12-month average, stands at $597,500. Meanwhile, the average price per square foot is calculated at $453 over the same period. These figures indicate the market’s value characteristics over the past year, offering a baseline for assessing property values in the area.

The sales data since January 1, 2023, shed light on the market dynamics over the previous year. Two houses were sold: one in February 2023, listed at $610,000 and sold for $615,000, indicating a sale above the listing price and suggesting a competitive market environment at that time. The second sale occurred in August 2023, with the property listed at $525,000 and selling for $580,000, again above the listing price, further supporting the notion of a seller’s market during these instances.

In summary, the Mira Loma Village residential area is currently experiencing a period of low inventory and market activity, with no new or active listings and no sales reported for February 2024.

However, the rolling average sales price and price per square foot, coupled with the sales details in the past year, provide a nuanced view of the market’s valuation and competition levels.

For potential sellers, the market’s past ability to support sales above listing prices may signal advantageous conditions should they choose to list their properties. For buyers, the current lack of inventory highlights the importance of readiness and swift action when new properties become available in this tightly held market.

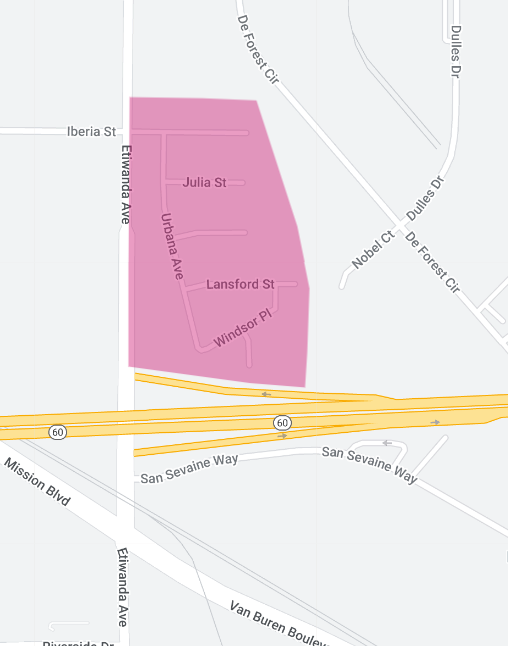

Area: Homestead,

(North-Western portion of Jurupa Valley 91752)

In our latest market update for the Homestead residential area as of February 2024, we observe a market characterized by stability and consistent performance compared to the previous year. This report aims to provide homeowners and potential buyers with a comprehensive overview of the current market dynamics, reflecting on key metrics and their implications.

Starting with the inventory levels, there were no active listings at the end of the month, mirroring the situation from the previous year. This consistency suggests a tight market with limited availability of properties for sale, potentially indicating a seller’s advantage due to the scarcity of options for buyers.

Despite the lack of active listings, there was one new listing introduced to the market this month, maintaining the same level of new market entries as the year before. This solitary new listing presents a rare opportunity for buyers in an otherwise static market landscape.

The months’ supply of inventory stands at a remarkably low 0.2 months. This represents a 50.0% decrease from the previous year, indicating an even tighter market than before. Such a low supply level underscores the competitive nature of the Homestead area, where demand significantly outweighs the available inventory.

Sales activity in the area remains stable, with two closed sales reported, consistent with the data from the previous year. This level of sales activity, combined with the extremely low inventory, suggests that properties that do come to market are likely to be sold quickly.

The average days on market for sold properties is 31, showing no change from the previous year. This stability indicates a steady pace in the market, where properties take about a month to sell, reflecting a balanced dynamic between buyers and sellers.

Financial metrics also show a remarkable consistency year-over-year. The list to sold price percentage stands at 99.6%, indicating that properties are selling very close to their listing prices, a sign of a healthy market where sellers can expect to achieve near their asking price.

The average sales price remains unchanged at $572,500, along with the average price per square foot at $489, suggesting stable property values in the Homestead area. This stability in pricing, despite the low inventory and consistent demand, indicates a market that has found a balance, at least for the time being.

In conclusion, the Homestead residential area presents a picture of remarkable stability and consistency as of February 2024. The tight inventory, combined with steady sales activity and stable pricing metrics, suggests a market that is balanced yet competitive.

For buyers, the low months’ supply of inventory highlights the importance of being prepared to act quickly on new listings. For sellers, the current market conditions suggest that it remains a favorable time to sell, with properties selling close to their asking price.

As we move forward, it will be interesting to see how these dynamics evolve, especially in terms of inventory levels and whether the market will see an increase in listings to meet the steady demand.

******

As a real estate broker, understanding the above nuanced market shifts is key to providing informed advice and strategy to sellers throughout the 91752-zip code area.

Contact me for a comprehensive understanding of how the above trends can impact your real estate decisions. I provide expert guidance and strategic insights and can guide you through these interesting times in real estate.

Manny Barba

Broker-Attorney-Realtor®

951-990-3998

MB Live Realty, Inc.

Note: All data in this report is from California Regional Multiple Listing Service (CRMLS) All information should be independently reviewed and verified for accuracy. This report is for informational purposes only and not intended as financial or investment advice.

No Comments